Is A Limited Benefit Health Program Right For My Company?

With more than half of U.S. employers now providing wellness programs for their employees, most of us have become pretty familiar with the concept and may have even participated in them ourselves. These programs are generally seen as a win-win for everyone – the employee gets healthier and can be more productive at work and the employer enjoys the reduced insurance premiums that come with having a healthy workforce.

However, there’s another type of program to promote health and wellness that employers may not be as familiar with – a Limited Employee Benefits Program offered through AXIS Group.

This supplemental program runs through Section 125, like other ancillary benefits which allow employers to establish a type of tax savings arrangement for their employees. Similarly, to programs such as Aflac, MetLife, or Colonial Life where employees are provided with the opportunity to pay for certain benefits pretax such as disability insurance, life insurance, and cancer policies on a pre-tax basis. In turn, this reduces the employee’s taxable wages.

Historically, if someone were to claim disability, they’d receive an after-tax indemnity claim payment through IRS Code Section 213(d). This is a classic example of what is considered a qualifying event in the eyes of the IRS. However, many people aren’t aware that several years ago, the IRS added education as a qualifying event to receive indemnity. Why is that? Well, to put it simply, the U.S. has become somewhat of an unhealthy society with obesity and sedentary lifestyles causing myriad health problems and threatening our quality of life. Making education an indemnity event represents a proactive way to change behavior and improve health outcomes, and that’s where the Limited Employee Benefits Program comes into play.

In addition to providing employees and their families with unlimited free telehealth sessions, $15 copays for in-office doctor visits and reimbursements for hospital stays, wellness coaching, the “secret sauce” of the Limited Employee Benefits Program is the educational component. Employees who participate can download an app upon enrollment and take classes on everything from smoking cessation to nutrition to diabetes management. Watching the videos triggers the qualifying event of education which then leads to an indemnity claim payment, resulting in a net positive increase in compensation.

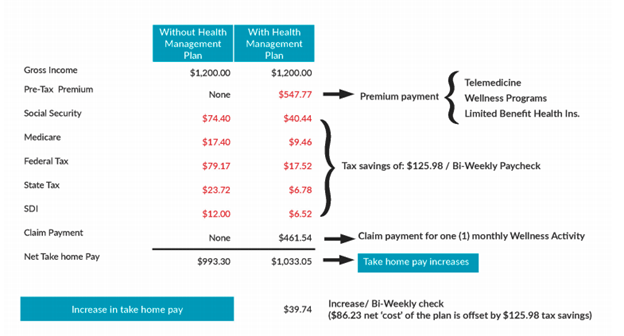

Here’s an example:

While the program is great for employees, it also has a huge benefit for employers because it doesn’t cost them anything. In fact, they end up saving about $500 per employee per year. That’s because as insurance premiums come out pre-tax, the taxable wage for employees is reduced. Looking for a true win-win? The Limited Employee Benefits Program comes pretty close.

Interested in learning more about Limited Employee Benefit Programs? Let the experts at AXIS Group help you determine if they’re right for your organization. Click here to contact us.